new mexico gross receipts tax rate

Skip to Main Content. The receipts are reported on the Leased Vehicle Gross Receipts Tax and.

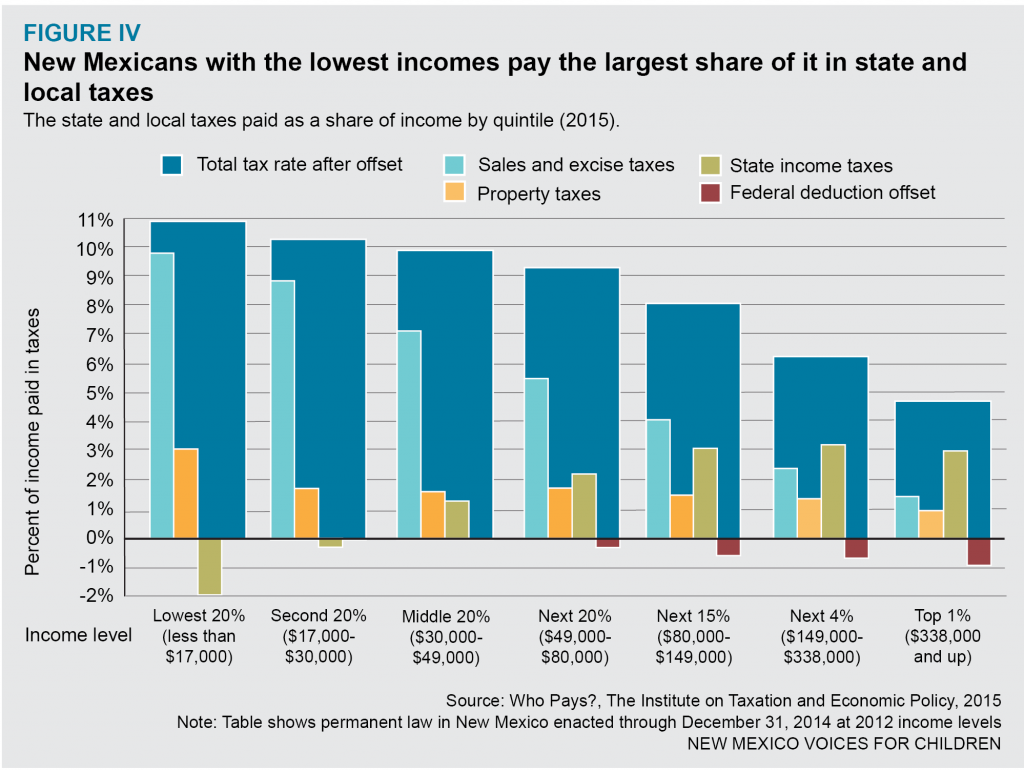

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

Check out the current gross receipts tax rates for Taos.

. Download map files from UNMs Resource Geographic Information System RGIS Gross Receipts Tax Rates and Boundaries. The current gross receipts tax rate in unincorporated portions of Sandoval County is 6375. Cities or towns marked with an have a local city-level sales tax.

Starting July 1 those businesses will pay both the statewide rate and local-option Gross Receipts Taxes. New Mexico charges a gross receipts tax on persons engaged in business in the state for the privilege of doing business in the state. Under the updated guidance most New Mexico-based businesses pay the GRT rate in effect where their goods or services are delivered.

Since 2019 internet sales have been taxed using the statewide 5125 rate. Specifically the state Senate unanimously approved a tax package that reduces New Mexicos gross receipts tax rate by 0025 percent over two years. The business pays the total Gross Receipts.

This would be the. Use a Tax Rate Table The New Mexico Dept. This would be the first.

The initiative announced by Lujan Grisham comprises a 025 reduction in the statewide gross receipts tax rate reducing the statewide rate to 4875. The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. Anyone who operates a business in New Mexico is familiar with the gross receipts tax or GRT a tax not on sales but on companies and people who do business here.

Effective July 1 2021 local option. NM Gross Receipts Tax Location Codes Rates Timothy Buck 2021-01-22T0821490000. Liquor Pawnbroker License Holders.

Of Tax Revenue publishes a table listing the. January to June 2022. NMHBA EVPCEO Jack Milarch explains the ins and outs of figuring out what the new Regulations.

Gross Receipts Tax Effective January 1 2022 through June 30 2022. On April 4 2019 New Mexico Gov. The governors initiative will comprise a statewide 025 percent reduction in the gross receipts tax rate lowering the statewide rate to 4875 percent.

Of that amount 5125 is the rate set by the state. Tax rates vary across the state from. Gross Receipts Tax Rate Schedule.

New Mexico City and Locality Sales Taxes. New Mexico Gross Receipts Tax August 2012 New GRT Rules. The leased vehicle gross receipts tax is imposed at a rate of 5 on the receipts from leasing vehicles.

The gross receipts tax rate varies throughout the state from 5 to 9 and frequently changes. Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location of interest. The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business.

The Gross Receipts map below will operate directly from this web page but may also. Select the GROSS RECEIPTS TAX RATES link for additional tax rate information and. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located.

It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT. Gross Receipts Tax Rate.

How To Design Tax Policy In Fragile States In Imf How To Notes Volume 2019 Issue 004 2019

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

New Mexico Sales Tax Small Business Guide Truic

Case Studies In Tax Revenue Mobilization In Low Income Countries In Imf Working Papers Volume 2019 Issue 104 2019

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

What You Should Know About Changes To Nm Tax Reporting Youtube

Lawmakers Taking Cautious Approach To Plan To Cut Grt Albuquerque Journal

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

Mapsontheweb Infographic Map Map Sales Tax

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal

Gross Receipts Location Code And Tax Rate Map Governments

A Guide To New Mexico S Tax System New Mexico Voices For Children

Gross Receipts Location Code And Tax Rate Map Governments

2016 Impuestos Como Porcentaje Del Pib 2016 Economic Analysis Gop Tax

A Blueprint For A Prosperous State New Mexico Voices For Children